Boeing has positioned itself to secure up to $35 billion in funding as the planemaker looks to shore up its position in the face of ongoing strikes and manufacturing difficulties that have dominated 2024.

On October 14, 2024, Boeing announced through a SEC filing that it had entered a credit agreement with several US banks to secure $10 billion.

Under the credit agreement with Bank of America, Citibank, Goldman Sachs and JPMorgan, Boeing will pay a funding fee of 0.50% of each advance made.

Additionally, in a second financial update Boeing laid the ground for the possibility of raising up to $25 billion through stock and debt offering.

“These are two prudent steps to support the company’s access to liquidity,” Boeing told Reuters in a statement.

It has been a torrid year for Boeing since a plug door separated from an Alaska Airlines Boeing 737 MAX 9 shortly after takeoff on January 5, 2024.

The fallout from the incident led to huge questions over Boeing’s safety and quality procedures during the aircraft manufacturing process.

Several whistleblowers appeared in front of Senate Committees to reveal questionable practices at Boeing’s facilities and aircraft production slowed leaving airlines around the world frustrated by undelivered planes.

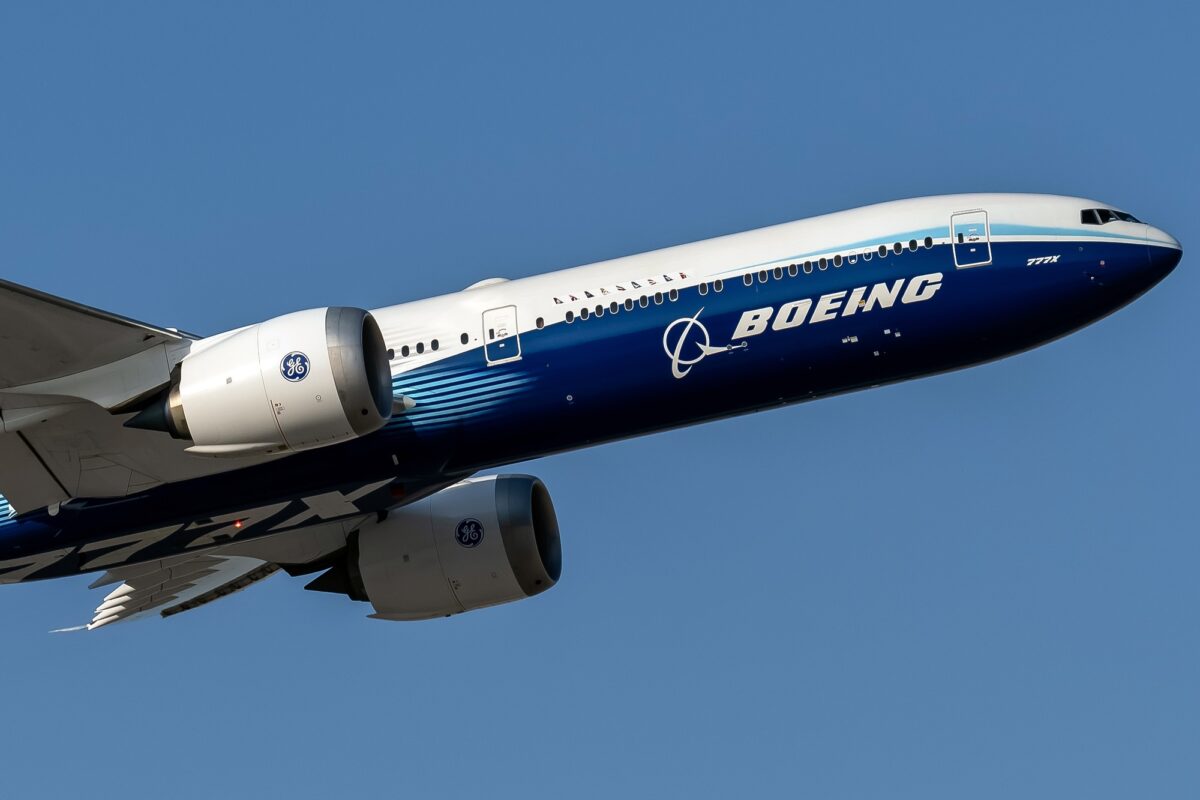

On October 11, 2024, Boeing CEO, Kelly Ortberg told employees that the delivery date for the first 777X aircraft has been pushed back to 2026 while production of MAX jets has also been severely hampered this year.